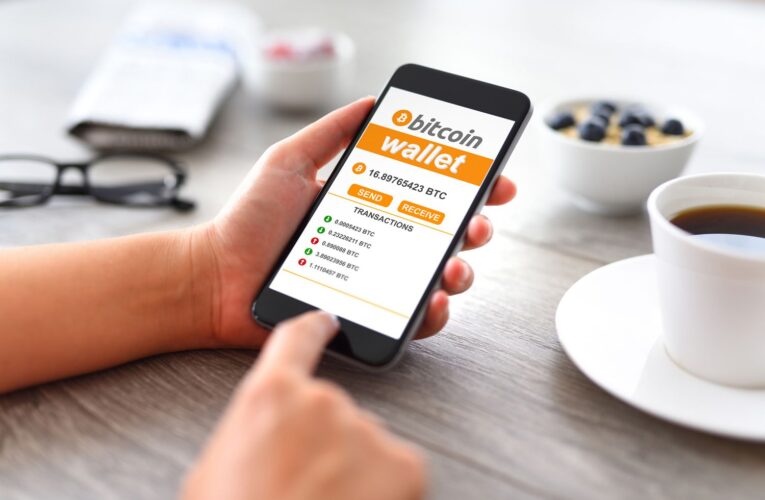

What is a Bitcoin wallet?

A Bitcoin wallet is a medium of information storage that stores private keys. Contrary to a common misconception, a wallet does not store any Bitcoin. It just grants user access to a certain amount of BTC associated with the wallet.

There are many different ways to store user’s private keys. After all, it is just a string of numbers and letters. All the wallets can be categorized according to several parameters:

Connectivity to the internet (hot vs cold)

Number of different cryptocurrencies it is designed to store (single currency, multicurrency)

Exact type of the wallet (paper, web, etc.)

Hot vs cold wallets

The first way to categorize the wallets is by their connectivity to the Internet. If the wallet is connected to the Web, it is a hot wallet. On the other hand, if the wallet is not connected to the Internet, it is a cold wallet. Each of these types has its own advantages and drawbacks.

Hot wallet

Hot wallet is connected to the Internet.

Pros of a hot wallet:

The funds are easy to access from anywhere.

Funds can be sent fast, which can be useful for daytrading .

Hot wallets are normally easy to use, with an intuitive interface.

There is a large number of Bitcoin cold wallets. It means that any user will be able to find one that is compatible with his/her operating system of choice, such as iOS, Android, Windows, Mac OS or Linux.

Cons of a hot wallet:

No matter how many security layers a particular hot wallet has, it will always be compromised in terms of safety. No wallet is 100% secure, but this is especially true when talking about hot wallets.

The performance can sometimes be sluggish, because the system runs on a centralized server.

Cold wallet

Cold wallet is not connected to the Internet.

Pros of a cold wallet:

Such a wallet is much harder to exploit, because it cannot be accessed by hackers from the Internet.

Cold wallets are a perfect option for investors wanting to buy crypto and hold it for a long period of time. For these people, cold wallet is an ultimate “buy and forget” option that needs no attention or maintenance

Cons of a cold wallet:

Cold wallets are generally more expensive than hot wallets. They always are pieces of hardware or some physical mediums of information storage, such as paper

When dealing with altcoins, it is easier to find a hot wallet compatible with a particular coin than a cold wallet. This situation is especially likely to occur if the altcoin in question is still not too popular.

In short, hot wallets can be described as more convenient but less secure. In contrast, cold wallets can boast enhanced security but are more difficult to use.

It might be useful to have both wallet types. Cold wallet can be used for storing Bitcoin and/or altcoins and hot wallet for sending small amounts of cryptocurrency and trading. Users also should remember about the vulnerable nature of hot wallets and try to store big amounts of cryptocurrencies on cold wallets only.

Single currency vs multicurrency

Cryptocurrency wallets, both cold and hot, can be designed to store either one particular cryptocurrency, such as Bitcoin or Ether, or a number of different coins. Usually, there aren’t any particular differences between these two wallet types. However, single currency wallets are more likely to offer some extra options related to the currency they store. For example, single currency Bitcoin wallets are more likely to offer full Lightning Network support than multicurrency ones.

Wallet types

There are many types of cryptocurrency wallets in existence. All of them exist for some reason and are tailored to the needs of different users. Because the needs of the users are not the same, there is no answer to the question “What type of Bitcoin wallet is the best?”. Sometimes a more convenient wallet can be a better choice for a particular use case, even if it means sacrificing some amount of security. In other cases, such a tradeoff makes no sense. Different users, different needs, different recipe for a “perfect cryptocurrency wallet”.

However, some of the wallets are more secure by design, as explained previously in the article. Here is a list of the most popular crypto wallet types, with the least secure options listed in the beginning and more secure ones in the end of the list.

Web wallet (hot)

Web wallets usually (but not always) store user’s private keys on a centralized server controlled by the company providing the wallet. Centralized exchanges, such as Binance, are technically web wallets with trading functionality. They are accessible from practically any device with a web browser.

Pros:

Web wallets are convenient and can be accessed from anywhere in a matter of minutes.

If a web wallet is a part of a crypto exchange, user can trade cryptocurrencies stored in it without having to make transactions.

Cons:

Highly vulnerable to cyber attacks, especially if the private keys of all users are stored on the single server. In this case, the wallet (or exchange) becomes a major target for hackers. Hack one server, get hundreds of private keys – sounds tempting, doesn’t it?

Use if:

You are a daytrader that wants to react to price fluctuations quickly.

You want to keep small amounts of cryptocurrency ready for quick transactions, such as payments.

Mobile wallet (hot)

Nowadays, almost everyone is carrying their smartphone around. Blockchain wallet developers recognized that an app for mobile platforms would be a perfect tool for those wanting to pay for goods using crypto on a daily basis.

Mobile wallet is a smartphone application which stores user’s private keys. It allows to pay for different products and services using crypto – however, the merchant must be accepting cryptocurrency.

Bitcoin mobile wallets cannot run a full Bitcoin client on a smartphone because of the memory limitations. Instead, such wallets use something called simplified payment verification (SPV). This is a less secure solution, but one that is at least possible to implement on a phone.

Pros:

Mobile wallets can provide extra functionality, such as NFC support. Of course, the features only work if they are supported by smartphone.

Cons:

An app can contain malware, especially when downloading from unofficial sources.

You can lose all the cryptocurrency if the phone gets stolen, for example.

Use if:

You want to use cryptocurrency for daily purchases.

Desktop wallet (hot)

This type of wallet is a computer program that stores user’s private keys. The fact that the keys are not stored on a server makes desktop wallets more secure than mobile and web ones. However, this type of wallet is still considered “hot”, because Bitcoin or any other cryptocurrency type gets stored on a device with Internet access.

Still, compared to the other types of hot wallets, desktop cryptocurrency wallets allow for a greater control of the private keys. There is a wide selection of desktop wallets, both open-source (which guarantees that there are no backdoors) and closed source.

Pros:

Wide choice of wallets with emphasis on different features. There are, for example, privacy-focused or security-focused desktop wallets.

Cons:

It is still a software piece, which might contain malware if it is downloaded from unofficial sources.

Use if:

You are frequently trading but do not want to keep your private keys on a third-party server.

Paper wallet (cold)

Paper wallet is, well, a piece of paper with public and private keys printed on it.

In order to create a paper wallet, user must use services like BitAddress, which generate public and private keys. Important: only choose services that generate private keys offline, and turn off the Internet access before starting the key generating process. To make sure that your computer is entirely secure, it is advisable to download and boot live version of Ubuntu (which is completely free!). One more safety precaution is to make sure you use printer that is not connected to the network.

The end result is a document with a QR code printed on it.

You should also remember that the paper can be stolen or physically damaged, so make sure you protect it accordingly. Usually, paper wallet users protect them by putting into sealed plastic bags or laminating them. Also, it is wise to store the wallet in a safe place.

Pros:

The wallet itself cannot possibly be hacked, because it is just a piece of paper.

Cons:

Security can be compromised during the creation of the wallet or importing it into the software when making transactions.

Paper is not durable, it can be easily damaged by the water, sun etc. if not protected properly.

Use if:

You want to buy crypto once and store it for a long time without worrying about hackers.

Hardware wallet (cold)

A hardware wallet is an electronic device designed solely for storing user’s private keys. As for the time of publishing, there have been no cases of cryptocurrency stolen from hardware wallets. This makes this type of wallet one of the most secure ones out there. In fact, it is even safer than paper wallet, because a paper wallet has to be imported to software eventually.

Typically, hardware wallet is a gadget that resembles a USB stick that has one or several buttons. Some of the wallets have an in-built screen which can display vital information, making them even more secure. When making a transaction, the wallet has to be connected to a device with Internet access, such as a PC or a mobile phone. Usually this is done with a USB cable, or, in some cases, with Bluetooth connection.

Pros:

- Easy to use.

- Highly secure.

Cons:

Hardware wallets are possibly the most expensive option of storing cryptocurrencies. The cost of devices ranges from several tens to several hundreds USD.

When buying a hardware wallet, user has to be extremely careful. Always buy the wallet from the official marketplace and never from websites like eBay.

Use if:

You want your cryptocurrency holdings to be as secure as possible.

Wonder which hardware wallet is the best? Find out in our guide!

Other options

Physical Bitcoin

Physical Bitcoin is a coin-shaped or a credit card-shaped object that contains public key and a private key under a peelable layer. Once the layer is peeled, both keys can be seen, but the object itself loses all its value.

In the last few years, companies producing physical Bitcoins have encountered regulatory problems. In some countries such a type of cryptocurrency wallet might be considered counterfeit money, making it not advisable to use one.

Smartphone with integrated hardware wallet

A few years ago various startups, such as Sirin Labs, started to produce smartphones with in-built hardware wallets. Sirin Labs’ smartphone, Finney, has a second screen and extra processing units dedicated solely to storing and sending cryptocurrencies. The company claims that its solution is highly secure.

However, it remains unclear why would anyone buy such a smartphone. Smartphones with integrated hardware wallet are generally more expensive and bulky than comparable “ordinary” smartphones. Finney phone, for instance, costs 1000 USD. Therefore, for ordinary users, it might be more logical to buy a “normal” smartphone and a hardware wallet (and have some money to spare).

Recently, large smartphone manufacturers, such as Samsung, have joined this trend and now allow users to store cryptocurrency on the smartphone out-of-the-box. However, this kind of solution is less secure than the smartphones with additional memory chip and processing unit dedicated solely to storing crypto and processing transactions.

The round-up

Here are the most important things you should remember:

Bitcoin wallet stores your private and public keys, not the coins. The coins themselves are always stored in the blockchain. Private key just gives you access to them.

There are single currency and multicurrency wallets out there.

It makes sense to choose wallet type depending on your particular use scenario

Cold wallets are generally safer, hot wallets – more convenient and easier to access from anywhere.

It is better to steer clear of Physical Bitcoin and analyze whether the smartphone with in-built hard wallet is worth it.

We hope you enjoyed the article. If you found it helpful, feel free to share it and join our community and digest!