Is It True that the Profitability of Bitcoin Mining is Declining?

When the famous cryptocurrency bitcoin emerged in 2009, no one guessed that it would reach today. The craze of cryptocurrency today is unparalleled. Recent trends from past years are proof of that. If you haven’t heard of bitcoin, you might be living under a rock. Let’s take a look at bitcoin mining for now.

What is bitcoin mining, you may ask? It is normal if you don’t have enough information about it. It is a way to earn bitcoins in exchange for operating the process of verification to validate transactions involving bitcoin. Such transactions provide security to the cryptocurrency’s network, and in turn, give bitcoins to the miners for compensation.

How do miners get profit?

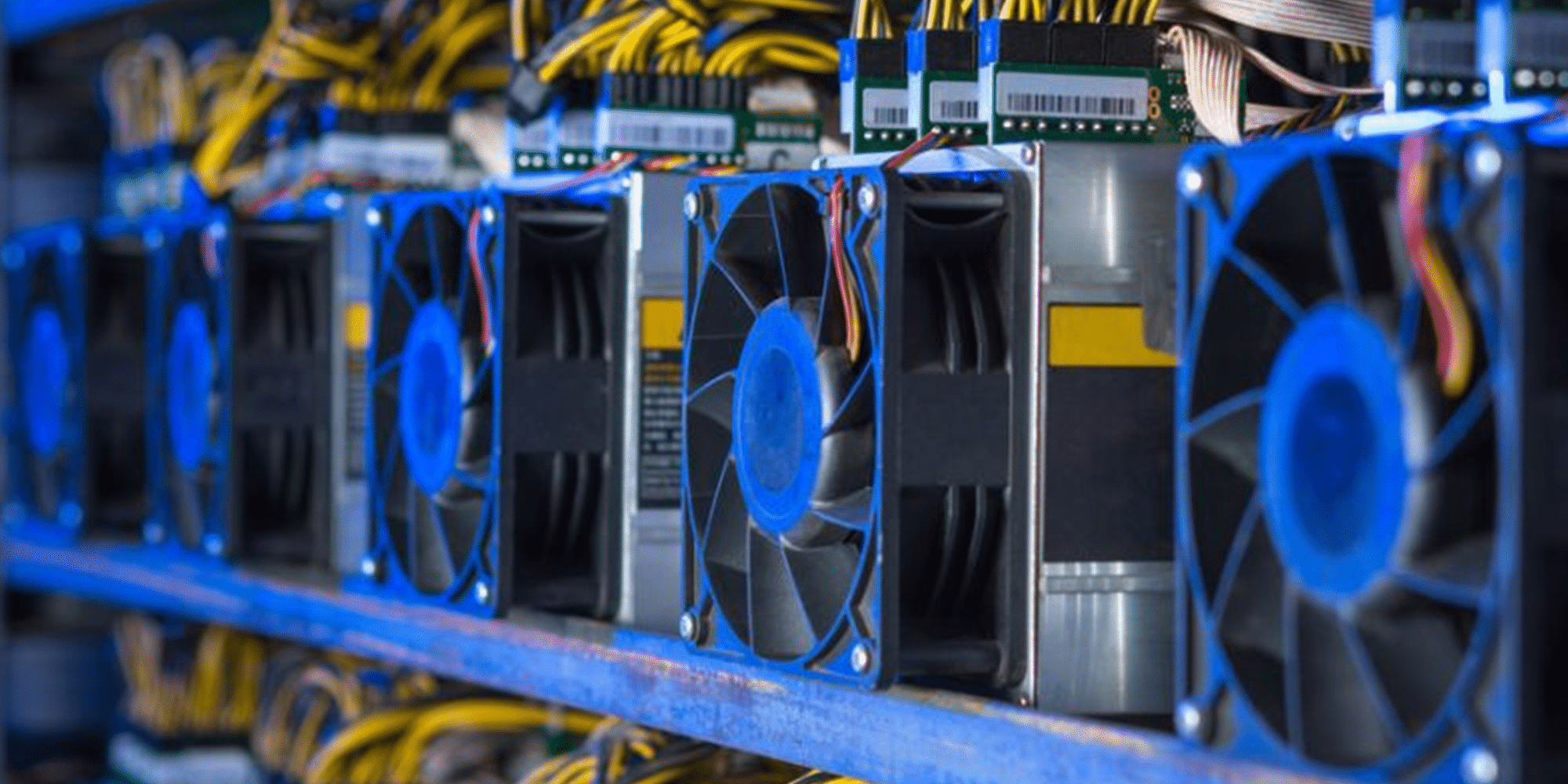

Miners can profit if the price exceeds the cost involved in mining bitcoins. There have been recent changes in technology and mining devices. Professional mining centers with enormous computing power and the shifting price of cryptocurrency have been emerging. All of this has changed the mining scenario.

Whether the bitcoin venture is profitable or not is decided by many factors. Let’s not dwell anymore on that. According to recent reports, the mining profitability levels of the bitcoin are on the decline after a sky-rocketed peak.

China’s breakdown on the mining of BTC and altcoin – began in early summer and intensified in late September. It took a toll on the global hash rate.

The rise in the profitability appeared till November, but then it declined according to the reports of ANKR price prediction.

The declining trends

- Bitcoin hash rate almost halved. With less competition from the BTC miners in China, growth was seen at the beginning of November.

- But, from November 9 to December 22, the cash flows of bitcoin mining have reduced by 36%. There was a decline of 28% in bitcoin prices along with an increase in the mining difficulty.

- The mining profitability fell to the levels last seen in July.

- Since the end of July, the mining difficulty has been rising because the Chinese miners set up new locations for their operation. With this development came new online investments, especially in North America.

- The difficulty in mining a bitcoin block adjusts automatically based on the hash rate for keeping the block stable.

- The biggest miners have many application-specific integrated circuits (ASICs) scheduled for the year 2022. Seeing the fact that the Chinese miners are getting back where they were, the hash rate is likely to be rise again next year, according to the miners.

- The point discussed above means that there “super profits” witnessed in 2021 will continue to rise in the initial months of the coming year.

- The world’s biggest mining firms have supported the above points in many interviews, with most of them believing that the hash rate will double next year with more machines at work.

But at last, profitability depends on the bitcoin’s price. If everything goes well in 2022, you might see the wonders of bitcoin as you have seen in the current year.